Understanding Capitalization Rates in Commercial Real Estate Valuation

One of the most pivotal metrics utilized by savvy investors is the capitalization rate, commonly known as the 'cap rate'. It provides a snapshot of a property's potential return on investment, offering invaluable insights into its profitability. In essence, it reflects the expected return on an investment, ignoring any financing or debt structure.

Deciphering the cap rate can be complex without the right guidance. Continue reading to unravel the intricacies of cap rates and discover how partnering with advisor can elevate your investment strategy.

Understanding Capitalization Rates and How They’re Calculated

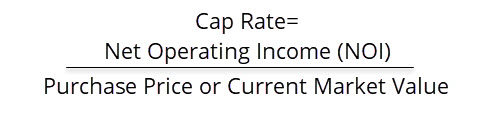

Capitalization Rate, often abbreviated as "cap rate", is a fundamental concept in the commercial real estate sector. The formula is simple but powerful, acting as a quick snapshot of the potential return a property might yield in its first year based solely on the purchase price.

- Net Operating Income (NOI): This represents the annual income generated by the property after all operating expenses, but before any mortgage payments or other financing costs. NOI is the heart of any real estate operation and represents the pure profitability of a property after considering costs such as property management, taxes, maintenance, and insurance.

- Purchase Price or Current Market Value: This is the total acquisition cost or the current market value of the property. It's essential to ensure that the price accurately reflects the current market conditions to get an accurate cap rate.

By dividing the NOI by the property’s price or its current value, the cap rate essentially shows what percentage return an investor can expect on their investment. For instance, a 7% cap rate means that, based solely on the purchase price and assuming the property operates at the predicted NOI, the investor can anticipate a 7% return on their investment in the first year.

It's crucial to note that while the cap rate offers a quick glance at potential profitability, it shouldn't be the sole metric when evaluating an investment opportunity. It doesn’t account for potential future value increases, financing costs, or other vital factors in an investment’s overall return. Still, it serves as a foundational starting point in the assessment process, especially when comparing different properties or market sectors.

What Level of Cap Rate is Considered Good?

Determining a "good" cap rate in the realm of commercial real estate isn't a one-size-fits-all answer. What's considered a favorable cap rate can vary significantly based on multiple factors, including the property's location, asset type, the current economic climate, and the inherent risks associated with the property. However, understanding the general benchmarks and the nuances behind them can be a crucial step in making informed decisions.

- Location and Market Demand: In prime areas with high demand and lower risk – think bustling city centers or rapidly growing neighborhoods – cap rates are generally lower. These areas often have stable tenant demand, leading to consistent rental income. Conversely, in areas perceived as higher risk or with less demand, you might find higher cap rates to compensate for the added uncertainty.

- Property Type: Different types of properties inherently carry different levels of risk. For instance, multifamily residential properties often have a lower cap rate than industrial properties or older retail establishments because they are seen as less volatile and more resilient to economic downturns.

- Economic Climate: During periods of economic expansion, cap rates might compress because of the increase in property values and demand for real estate. On the other hand, in times of economic uncertainty or downturns, cap rates might expand as investors seek higher returns to compensate for the greater risks.

- Interest Rates: Generally, there's an inverse relationship between interest rates and cap rates. When interest rates are low, financing costs are reduced, potentially leading to higher property values and lower cap rates. Conversely, when interest rates rise, the cost of borrowing increases, which can lead to expanded cap rates.

So, what's a "good" cap rate? While numbers can range from as low as 3-4% in prime, high-demand areas to 10% or more in riskier markets, it's essential to understand that a higher cap rate means higher potential returns but also indicates higher perceived risk. Conversely, a lower cap rate generally points to a lower return but is often associated with lower risk.

How Interest Rates Affect Cap Rates

Interest rates and cap rates are intricately linked in the realm of commercial real estate, with changes in one often influencing the other.

- Inverse Relationship: Typically, as interest rates rise, cap rates tend to increase, and the opposite holds true when interest rates decrease. This relationship stems from several underlying factors:

- Cost of Capital: Lower interest rates make borrowing cheaper, potentially driving property prices up. With a given Net Operating Income (NOI), this means a lower cap rate due to the higher property value.

- Alternative Investments: When interest rates go up, other investment options, like bonds, might appear more attractive. As a result, investors could demand higher returns from real estate, pushing cap rates up.

- Perceived Risk: A rise in interest rates might indicate economic concerns, such as inflation. This can elevate perceived risks, prompting investors to seek higher cap rates as compensation.

- Economic Impacts: Higher interest rates can potentially dampen economic growth, leading to increased property vacancy rates or reduced rental growth, which in turn affects NOI and cap rates.

- Valuation Impact: Since property value is derived from dividing the NOI by the cap rate, shifts in cap rates directly influence property valuations.

While these general trends provide guidance, individual market conditions, property specifics, and broader economic factors can introduce nuances. Therefore, it's always crucial to look at the bigger picture.

Other Factors that Influence Cap Rate

While interest rates play a significant role in shaping cap rates, they aren't the sole determinant. Cap rates are influenced by a myriad of factors that can vary depending on market conditions, asset type, and geographic location. Understanding these can offer a more comprehensive perspective on property valuation.

- Property Condition and Age: Newer properties with modern amenities and fewer expected maintenance issues typically command lower cap rates compared to older, potentially more problematic buildings that might have higher associated risks.

- Tenant Quality: Properties leased to high-credit tenants, such as national chains, often have lower cap rates because of the perceived stability these tenants bring. Conversely, properties with less established tenants might reflect higher cap rates due to increased risk of vacancies or payment issues.

- Lease Length and Structure: Longer-term leases with built-in rent escalations can stabilize a property's income stream, potentially leading to lower cap rates. On the other hand, properties with short-term leases or high turnover can carry a higher cap rate.

- Market Liquidity: In markets with a high volume of transactions and many active buyers and sellers, the liquidity is often better, which can drive cap rates down. In less active markets, the perceived illiquidity can push cap rates up.

- Economic Growth: The overall health of the economy impacts cap rates. Rapid economic growth can lead to increased demand for commercial spaces, potentially driving cap rates down, while economic downturns can have the opposite effect.

- External Events: Unforeseen events such as geopolitical tensions, global health crises, or significant regulatory changes can introduce uncertainties into the market, influencing cap rates.

Can You Always Use Cap Rate as a Metric?

The capitalization rate is undeniably a pivotal metric in commercial real estate, helping investors quickly assess a property's potential return relative to its price. However, like all metrics, it has its limitations and isn't always the most appropriate measure for every scenario. Let's delve into the contexts where the cap rate is most effective and situations where investors might need to consider alternative metrics.

Strengths of Cap Rate:

- Comparative Analysis: Ideal for comparing similar properties in the same market.

- Market Trends: Useful for gauging market sentiment and investment attractiveness over time.

When to Be Cautious:

- Different Property Types: Cap rates may vary significantly between property types.

- Operational Complexity: Not always suitable for properties like hotels with intricate operational elements.

- Temporary Distortions: If a property's NOI is temporarily high or low, cap rates might not reflect true value.

Other Metrics to Explore:

- Gross Rent Multiplier (GRM): A simpler metric focused on gross rents, often used for residential properties.

- Internal Rate of Return (IRR): Captures the potential return over multiple years, factoring in the time value of money.

- Net Present Value (NPV): Ideal for development projects, assessing profitability in present value terms.

In summary, while cap rates offer valuable insights, their effectiveness can vary based on context.

How Cap Rate Differs from ROI

In the realm of commercial real estate, understanding the difference between the capitalization rate (cap rate) and Return on Investment (ROI) is crucial. Both metrics offer insights into a property's potential returns but approach the topic from distinct perspectives. Here's a concise breakdown of their differences:

Definition:

-

Cap Rate: This metric provides a snapshot of a property's potential return based solely on its purchase price and annual net operating income (NOI). It's calculated as:

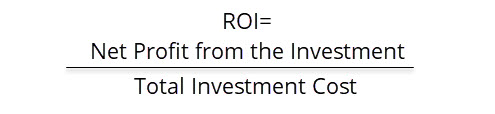

- ROI: This is a broader metric that measures the total return on an investment relative to its cost. It's calculated as:

What They Measure:

- Cap Rate: It gives investors an idea of the rate of return on a property's value without factoring in financing methods or future cash flows. It's predominantly used to compare potential returns from different properties in a given market.

- ROI: It encompasses all earnings and costs associated with an investment, including capital gains, rental income, financing costs, and more. It provides a comprehensive view of the total return over the investment's duration.

Use Cases:

- Cap Rate: Best for quick comparisons between similar properties or assessing market trends and conditions.

- ROI: More suitable for individual investment evaluations, especially when financing methods differ, or when an investor wants a holistic view of potential returns over time.

Limitations:

- Cap Rate: Doesn't account for financing strategies, potential appreciation, or future cash flow variations.

- ROI: While comprehensive, ROI can vary significantly based on the timeframe chosen for evaluation and assumptions made about future costs and revenues.

Navigating the complex landscape of commercial real estate valuation requires a clear understanding of essential metrics like cap rates and ROI. These tools, while invaluable, have their nuances and contexts where they shine brightest. As investors seek to make informed decisions, it's crucial to grasp these distinctions and to consider a property's broader financial and market context. To streamline this journey and to unlock the full potential of your investments, lean on the expertise and experience of Millennium Properties. Reach out to Millennium Properties today and elevate your investment strategy to new heights.